For Investors

Invest with Fundsec.

Whether you are seeking stable, asset-backed returns or bespoke lending solutions, Fundsec delivers expertise, security, and flexibility to help you achieve your financial goals.

The Opportunity

Access to Australia’s Resilient

Real Estate Market.

With a total value of AUD $10.9 trillion, the Australian residential real estate market continues to demonstrate resilience and growth. Fundsec strategically invests in high-demand regions, ensuring security and strong appreciation potential for our mortgage-backed assets.

Requirements

Credit Criteria.

Understand how loans are assessed with our credit criteria.

-

Thorough evaluation of the collateral, which primarily consists of Australian real estate properties.

-

Character and track record of the borrowers are carefully evaluated.

-

The committee will assess the borrower's capacity to repay the loan within the agreed term based on their exit strategy. This strategy may include sale of the security property or other real estate assets, refinance to another funder, reliance on business cashflow or any another acceptable strategy.

-

Borrowers must fulfil rigorous lending requirements and be accepted by & credit committee with decades of credit and mortgage expertise.

Investment Strategy

Why Partner with Fundsec?

Whether you are seeking stable, asset-backed returns or bespoke lending solutions, Fundsec delivers expertise, security, and flexibility to help you achieve your financial goals.

Diversified and Secure Portfolio

Our portfolio spans multiple loans, property types, and regions, reducing market volatility risk. With a low Loan-to-Value Ratio (LVR) historically averaging 53%, and 84% of our portfolio consisting of first mortgages, we prioritise stability and security.

Enhanced Liquidity & Flexibility

Fundsec offers strong liquidity with flexible redemption and reinvestment options after an initial 12-month holding period, providing easy access to capital while supporting solid investment performance (subject to fund liquidity).

Rigorous Risk Management

We employ systematic credit analysis, partner with top-tier valuers, and leverage our liquidity support scheme. These measures ensure effective exit strategies and safeguard your investment.

Proprietary Deal Sourcing

Fundsec’s has access to Money Guest Group 620 broker network that provides a first look at the private credit market’s best loan opportunities.

Investment Record.

Fundsec has a superior track record, successfully completing over 102 projects with a total portfolio value of AUD $128.8 million since its establishment [as of 1 Oct 2024].

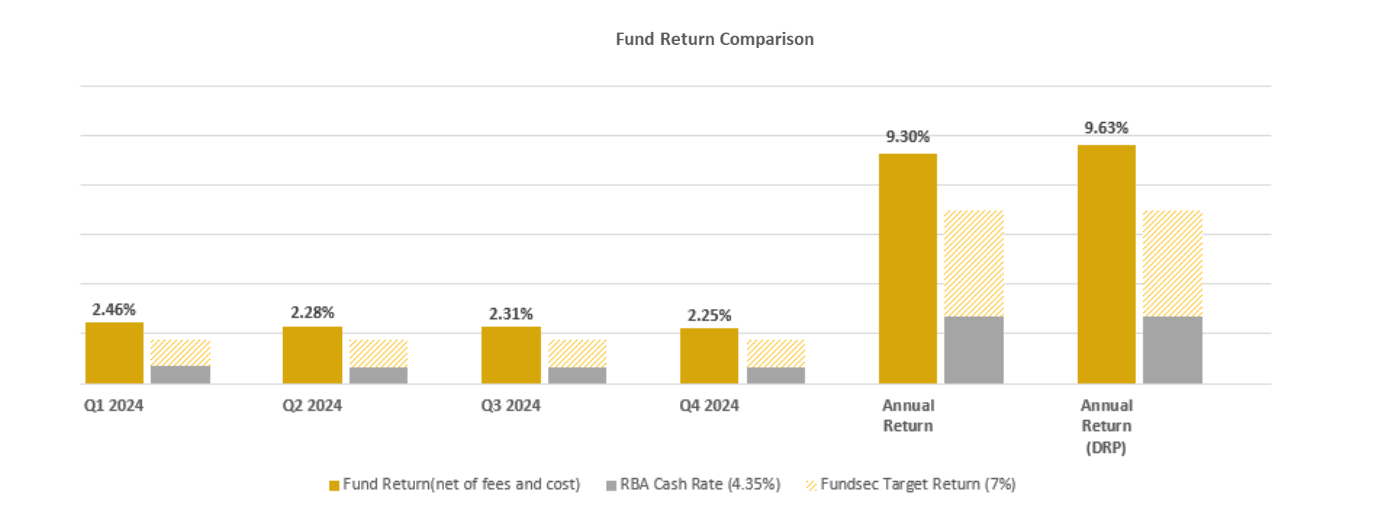

Fund Performance.

From October 2023 (since inception).

Key Figures.

Over $58 million (AUD)

Since inception in January 2023.

138 Deals

Settled since 2023.

$166.8 million (AUD)

Portfolio asset value.

$3.68 million (AUD)

Accumulated distribution to investors.

All figures as of 28 February 2025 (unless otherwise indicated).

Key Features

Fundsec Mortgage Fund Objective.

The fund investment objective is to preserve investor capital while delivering a quarterly income within the target range.

Eligible Investors

Wholesale only

Inception

October 2023

Minimum Investment

$100,000

Minimum Period

12 months

Distribution

Quarterly

Applications

Semi-monthly

Distribution Reinvestment Plan

Available

Fund Leverage

Nil

Target Loan Size

$50k to $25m

Term of Targeted Mortgage Loans

3 to 24 months

LVR

<70%

Loans Settled Since Inception

102

Underlying Assets

Indirect Investments in mortgages 100% secured by Australian properties.

Additional Benefits.

Partner with Fundsec and experience our difference.

Direct Investment Opportunities

Fundsec also offers investors exclusive opportunities to participate in direct mortgage investments, combining security and attractive returns.

Pipeline Opportunities

Fundsec has a strong track record, successfully completing over 102 projects with a total portfolio value of AUD $128.8 million since its establishment. Our ongoing projects pool demonstrates a commitment to identifying high-quality, low-risk investments across various property types and regions.

Unique Deal Sourcing Advantages

Leveraged by the existing financing expertise network of over 600 internal professionals within Fundsec group covering all across Australia, as well as a reputable presence and well-established professional social networks cultivated over 25 years in Australia.

Commitment to Excellence

Fundsec’s decades of expertise, rigorous due diligence processes, and robust risk management ensure superior outcomes for our investors. By leveraging extensive networks and industry insights, we consistently source high-quality investment opportunities to deliver value-driven results.

Investor Enquiries

Join Us Today.

Explore the benefits of partnering with Fundsec and secure your investment in Australia’s resilient mortgage-backed real estate market. For inquiries, contact us.